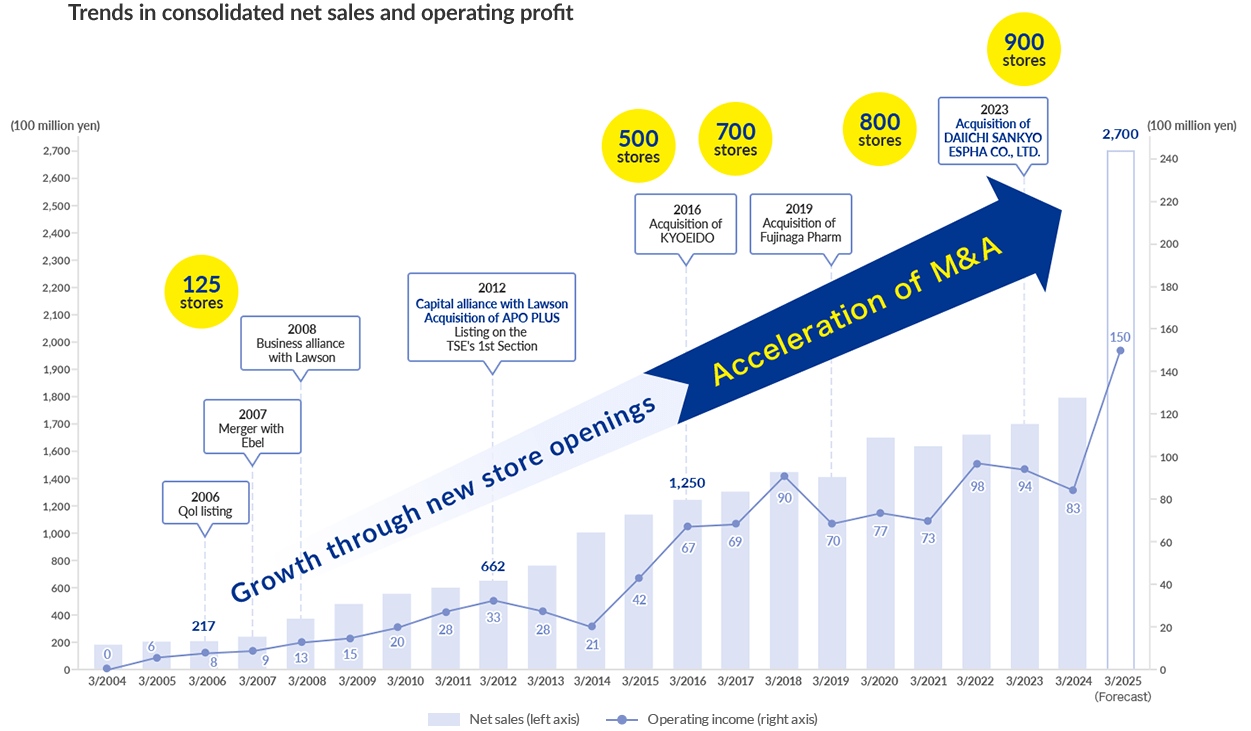

Since the first Qol pharmacy opened in Nihonbashi Kabutocho in 1993, the Pharmacy Business has steadily expanded its network of stores.

We have expanded our business by developing new styles of stores through a business alliance with Lawson in 2008 and proactive M&A.

We have also branched out into other areas, achieving full-scale entry to the CSO business through the acquisition of APO PLUS STATION Co., Ltd. in 2012 and entering the Pharmaceutical Manufacturing Business through the acquisition of Fujinaga Pharm Co., Ltd. in 2019.

With DAIICHI SANKYO ESPHA CO., LTD. also joining the Group in April 2024, the Pharmaceutical Manufacturing Business is now second only in size to our core Pharmacy Business.

Industry trendsChanging industry trends and the insurance pharmacy market

Point1Pressure on pharmacies to shift from product focused to patient focused

In Japan, which is becoming a super-aged society and faces the huge challenge of reducing national medical care expenses, the environment remains very tough for the pharmacy industry amid NHI drug price and medical fee revisions.

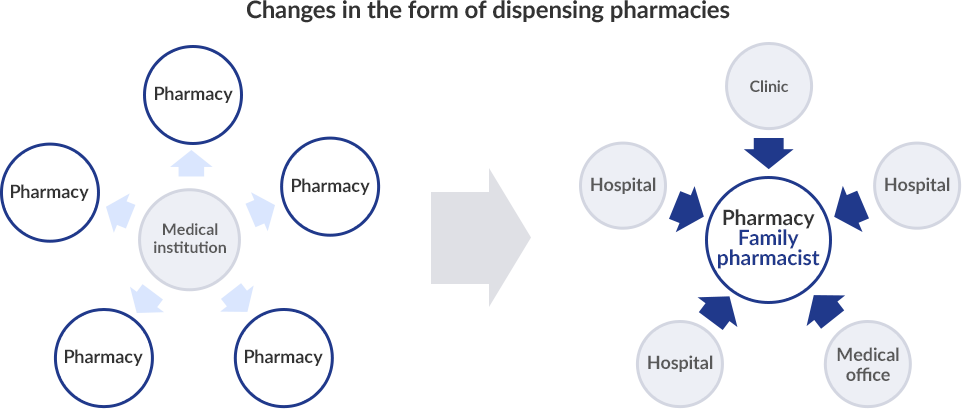

The main role of pharmacists used to be to measure out drugs and prepare medicine bags, and receive and store prescriptions and their role was considered to be product focused.

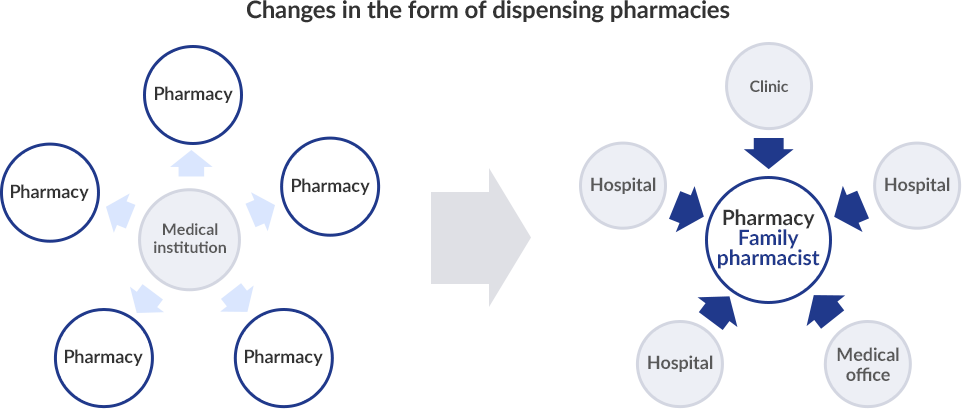

However, Pharmacy Vision for Patients published by the Ministry of Health, Labor and Welfare in 2015 indicated as part of the government's basic approach a shift away from product focused services toward the provision of patient focused care, and the transition to family pharmacies that provide more comprehensive support to individual patients is currently underway.

Furthermore, a pharmacy certification system under which pharmacies with specific functions are certified by prefectural governors was launched in 2021.

There are two types of certified pharmacies, Community Medical Coordination Pharmacy and Pharmacy in Cooperation with Specialized Medical Institutions, both embodying the functions pharmacies will be required to fulfil in the future.

Through such family pharmacies, Community Medical Coordination Pharmacies and Pharmacies in Cooperation with Specialized Medical Institutions, patients are now able to choose the pharmacy that will provide them with the in-person services most suited to their needs.

We are entering an era in which patients will actively choose dispensing pharmacies, and only those that can respond to the various needs of consumers are likely to survive.

Promotion of Pharmacy DX (Digital Transformation) for the enhancement on in-person services

Increasing the efficiency of in-person operations is also important in order to enhance the in-person services provided by pharmacies.

The Ministry of Health, Labor and Welfare is promoting the digital transformation (DX) of pharmacies, and online services such as medication guidance, refill prescriptions and electronic prescriptions are being introduced.

Adaptability to such digitalization is also likely to become a factor differentiating pharmacies from each other from a patient convenience perspective.

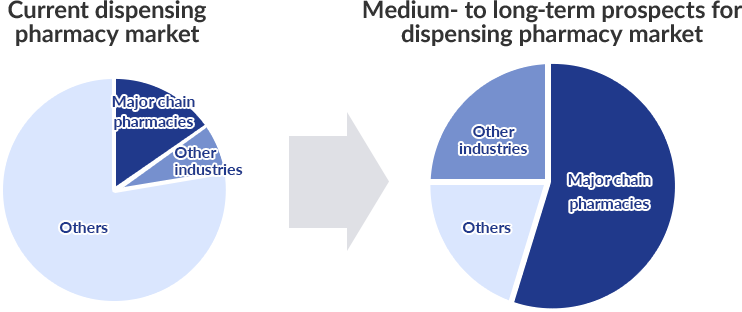

Point2 Integration into major chains and market entry by players from other industries

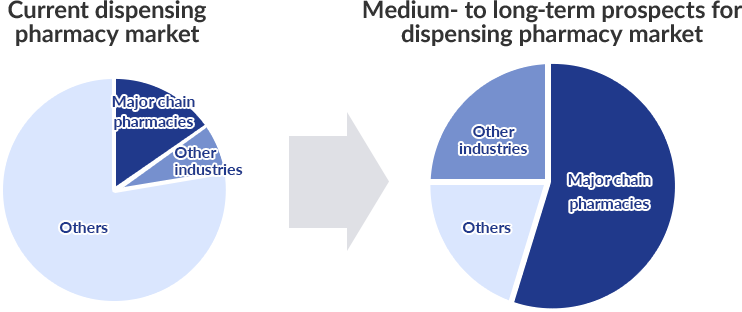

Moreover, with dispensing pharmacies now required to meet diverse medical needs as family pharmacies and certified pharmacies, going forward, we are likely to see further integration of pharmacies into major chains, including Qol, and increased market entry by players from other industries such as supermarkets and drug stores.

Industry trendsChanging industry trends in the pharmaceutical market

In the pharmaceutical industry, efforts are being made to effectively use digital technologies such as AI to develop highly specialized novel drugs such as antibiotics and to transform business models to maximize profit.

However, the Japanese Government is continuously reducing drug prices as a means of controlling medical care expenditure, and new drug development is becoming increasingly difficult, with companies running the risk of able to generate the profit they had expected even if they do successfully develop a new drug and gain regulatory approval.

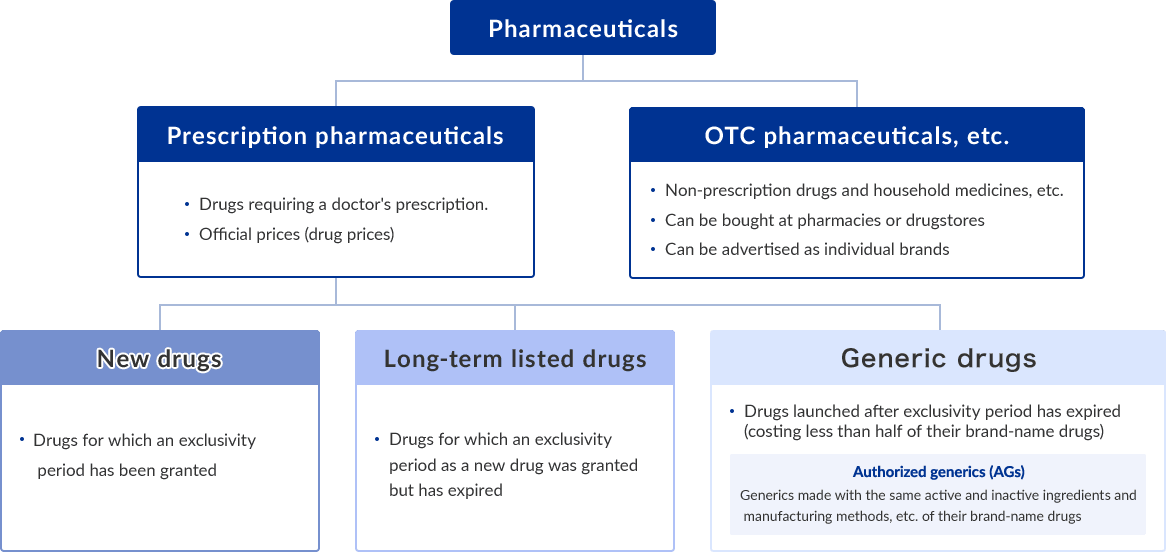

Under such conditions, there is a tendency among pharmaceutical companies to concentrate their management resources on a specific area, with some companies focusing on the development of new drugs and other focusing on manufacturing long-term listed drugs and generics.

Point1Promotion of wide-spread use of generic drugs

The Government has promoted the widespread use of generic drugs in order to curb expanding medical care expenditure and maintain the healthcare system.

The volume share of generics in the Japanese prescription drugs market has now grown to approximately 80%; however, the Government aims to promote further use by setting a new target on a value basis.

Meanwhile, in addition to calls for more widespread use of generics, there has also been pressure on generic manufacturers to step up initiatives to ensure quantity control following cases of quality problems with generics in recent years.

Point2"Quality assurance" and "stable supply" as key to survival for generics manufacturers

In the wake of the discovery of non-conformities in certain generic drugs in 2020, various manufacturers temporarily suspended their operations or recalled products and generic drug supply shortages have become an issue.

A remote cause of this issue is perhaps the rapid expansion of the generic drugs market.

The market share of generic drugs by volume was less than 40% as of 2011 but it now stands at around 80% as a result of the government's strong encouragement of more widespread use to reduce medical care expenditure.

Many pharmaceutical manufacturers entered the generic manufacturing business but, as the market grew rapidly, there were no doubt some companies that neglected their manufacturing and control systems.

The government is now aiming to eliminate these issues at an industry structure level by rolling out measures to ensure the survival of generics that prioritize "quality assurance" and "stable supply" from the viewpoint of providing the Japanese people with a stable supply of the pharmaceuticals they need.